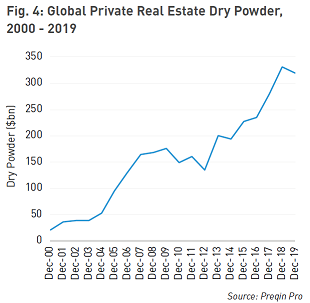

Given the amount of cash ready to jump in at the first sign of distress, will there even be a dip in the capital markets? Time will tell, but it’s safe to say that investors are gearing up for a once-in-a-decade buying opportunity. Some are deploying capital today, while others await developments in the pandemic before they strike. In this article, I will explain why I believe the buying opportunity will begin this fall.Investors have waited years for a dip in the market to acquire distressed real estate assets. According to Prequin, “dry powder” (aka cash on hand to purchase global commercial real estate) totaled $319 billion at the end of 2019. This number, while lower than 2018’s total ($331 billion), is well above long-term averages and, by comparison, close to double the dry powder that was available in 2007 ($170 billion).

Announced in their earnings call last week, The Blackstone Group alone holds $152 billion of undeployed capital ready to take advantage of the downturn.

When is the right time to strike? It depends on the asset type and the longevity of the virus. Right now, opportunity already exists within sectors with higher human density—namely hotels and retail. These asset classes are particularly vulnerable if purchased within the last two years, as they were likely acquired ‘above-market’ and over-leveraged.

Experienced investors will let the dust settle and wait for opportunity to present itself in other asset classes. For some investors, that means three months; for others, closer to a year. The “dust” in question is clarity on the containment status of COVID-19, as well as the duration of forbearance granted by lenders.As it relates to COVID-19, investors are looking at two things: containment and a vaccine. Social distancing has proven to be effective and research supports the idea that the virus spreads less quickly in warm and wet climates, portending a slowdown in the summer.

However, states are already reopening their economies despite research that predicts a resurgence of the virus in the fall. The most optimistic research shows that we won’t have an anti-viral therapy until this fall and a vaccine will not be ready until fall of 2021. If the virus resurges without a vaccine in sight, consumer optimism will decline, taking with it the economy.

The forbearance period provided by federally-backed multifamily lenders through the CARES act has just started and will last up to six months, with the option to extend for an additional six months. According to Fitch Ratings, 640 borrowers have requested forbearance under this program, totaling $5 billion in unpaid debt.

Private, non-federally backed lenders who traditionally lend to larger commercial real estate investors of all asset types may be significantly less forgiving on the duration of loan forbearance requests. This is where the opportunity will lie.Assuming the economy persists at recessionary levels when the forbearance period concludes, borrowers will begin to default. Banks will have to decide whether to “hold the keys” or sell the loan at a discount to avoid a lengthy foreclosure lawsuit. So far, mortgage defaults have been few and far between, but investors are gearing up to pounce on the opportunity.

More conservative investors worry that jumping in too early could be risky. They fret about the carrying costs associated with buying before the market has bottomed out, considering that valuations and occupancy levels could remain depressed for a long time. Additionally, investors remember 2008 when lenders lost their appetite for risk and made it far more difficult for buyers to assume a loan. Already, most lenders require a 30-35% down payment on commercial real estate loans as opposed to the traditional 20-25%, albeit with historically low interest rates. After a year has passed, lenders and investors alike will have more clarity on the status of the market and will be more inclined to deploy capital.

According to Real Capital Analytics, commercial property prices fell 35% between August 2008 and June 2010. Since 2010, commercial real estate prices have more than doubled. Prices have room to decline. I believe that the termination of loan forbearance, coupled with a soon-to-follow resurgence of COVID-19, will occasion that decline this fall.

Posted 28th April 2020 by Scott@CTInvestorsRealty